More Information About Wage Inequity

This page is a work-in-progress. More information will be added on a regular basis. If you have a suggestion for information that would be helpful, please send us a note and include a link to the source. We appreciate your input!

Understanding the Living Wage

A living wage and a fair wage are not quite the same, but both are important. A living wage reflects an amount necessary for someone to earn a basic living and pay for the essential elements, and it varies by family size. A fair wage means being compensated with a similar wage to what others in the same general area earn for the same job.

From MIT (Massachusetts Institute of Technology):

Understanding the Living Wage

While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip, it fails to approximate the basic expenses of families in 2021. Consequently, many working adults must seek public assistance and/or hold multiple jobs to afford to feed, clothe, house, and provide medical care for themselves and their families.

While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip, it fails to approximate the basic expenses of families in 2021. Consequently, many working adults must seek public assistance and/or hold multiple jobs to afford to feed, clothe, house, and provide medical care for themselves and their families.

Establishing a living wage and an approximate income needed to meet a family’s basic needs would enable the working poor to achieve financial independence while maintaining housing and food security. When coupled with lowered expenses for childcare and housing, the living wage might also free up resources for savings, investment, and the purchase of capital assets (e.g., provisions for retirement or home purchases) that build wealth and ensure long-term financial stability and security.

Read more here:

Understanding the Living WageWhat is the Living Wage in My State?

From the Living Wage Calculator developed by MIT:

WHAT IS THE LIVING WAGE CALCULATOR?

Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses. The tool helps individuals, communities, and employers determine a local wage rate that allows residents to meet minimum standards of living.

See the living wage for your state here:

View the Living Wage for My StateEmployee Rights Under the National Labor Relations Act

If you feel that you’re not being paid a fair wage by your employer, you have the right to do something about it.

From the National Labor Relations Board website:

Employees covered by the National Labor Relations Act are afforded certain rights to join together to improve their wages and working conditions, with or without a union.

Union Activity

Employees have the right to attempt to form a union where none currently exists, or to decertify a union that has lost the support of employees.

Examples of employee rights include:

- Forming, or attempting to form, a union in your workplace

- Joining a union whether the union is recognized by your employer or not

- Assisting a union in organizing your fellow employees

- Refusing to do any or all of these things

- To be fairly represented by a union

- Activity Outside a Union

Employees who are not represented by a union also have rights under the NLRA. Specifically, the National Labor Relations Board protects the rights of employees to engage in “concerted activity”, which is when two or more employees take action for their mutual aid or protection regarding terms and conditions of employment. A single employee may also engage in protected concerted activity if he or she is acting on the authority of other employees, bringing group complaints to the employer’s attention, trying to induce group action, or seeking to prepare for group action.

A few examples of protected concerted activities are:

- Two or more employees addressing their employer about improving their pay

- Two or more employees discussing work-related issues beyond pay, such as safety concerns, with each other

- An employee speaking to an employer on behalf of one or more co-workers about improving workplace conditions

Read more about employee rights under the National Labor Relations Act here:

Employee Rights Under the National Labor Relations ActIs Forming a Union the Answer?

Unions have been in and out of favor over the years. When employers step up and do right by their employees, a union is likely unnecessary. And unions in a workplace can come and go, too. They come in many shapes and sizes, depending on what the issues are to be addressed. Lately, with the increased visibility to workplace issues and fair wages, unions are making a comeback. Here’s an interesting story by CBS News on the growing popularity of unions.

Why do I get different data from Indeed, Zip Recruiter, Intuit, etc.?

The answer is simple: job boards and tax filing sites gather data based on their limited base of users. The data presented on this website is the official wage data gathered by the Bureau of Labor Statistics based on their quarterly surveys of employers. This is the standard that any reputable employer should use. Data gathered by a specific website’s users should be taken with a grain of salt… along with some tequila and lime wedge! It’s NOT official or representative of an acceptably consistent, broad source or method of data collection.

Health Care Costs Must Be Considered When Wages are Set

One of the greatest expenses families face these days is healthcare. Healthcare costs are a significant factor when considering the income one requires to afford a reasonable quality of life. Public policy could transform not only our healthcare, but our overall quality of life.

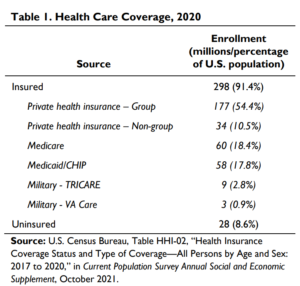

As of 2020, 39.9% of people in the U.S. received a form of public healthcare under Medicare, Medicaid or Military. This statistical information is provided by the Congressional Research Service, a component of the Library of Congress, which is a non-partisan agency that conducts research and analysis for Congress on a broad range of national policy issues.

What can be done?

Lower wage earners spend a higher percentage of their income on healthcare, leading to increased wage inequity.

Lower wage earners spend a higher percentage of their income on healthcare, leading to increased wage inequity.

While a “Medicare for All” style plan struggles for approval, simply lowering the age from 65 to 60 would have a significant effect for all Americans. This would remove much of the highest risk pool from the private health insurance market, enabling providers to offer lower premiums for those who remain. Since healthcare is a major cost factor in determining when to retire, it would also enable many employees to retire earlier, creating jobs for younger workers.

If we could institute a true “Medicare for All” style program, employers could use the funds saved from not having to provide private healthcare to increase employee wages to an actual livable wage. It’s truly a win-win!

Here’s the full Congressional Research Service report:

U.S. Healthcare Coverage ProfileHere’s another interesting article from the Kaiser Family Foundation, a leader in healthcare policy and research. They recently published a study on the cost of healthcare and how it affects families. With more than 60% of health insurance being provided through the workplace, employers have an obligation to either provide affordable healthcare insurance, or provide a wage that enables their employees to afford the coverage:

Americans’ Challenges with Health Care Costs